Budgeting 101: Guide to Start Budgeting

Creating a budget is the first step in establishing financial stability and security. However, it can be daunting if you’ve never done it. In this Budgeting 101 guide, we’ll cover the basics of establishing a budget, including which tools to use, which steps to follow and tips for making the most of the practice.

Put simply, a budget is a comprehensive summary tracking and comparing income and expenses over a month. Contrary to popular belief, following a budget doesn’t mean you’ll severely restrict your spending, and it’s not just for people who are “broke.” Instead, it’s a powerful tool for achieving your financial goals.

10 Step Guide for Creating and Using a Budget

Step #1 - Choose a Budget Planning Tool

Since budgeting involves tracking income and expenses, you need to choose a budget planning tool that works for you. There are two primary options: mobile apps and paper planners.

Budgeting Apps

For a budget to work, you ideally should track your expenses on a daily basis. Since most people keep their mobile devices with them at all times, budgeting apps are popular options.

Today’s most popular budgeting apps sync with bank accounts and credit card accounts, providing a lot of automation that can save time and improve accuracy. However, they still require you to input spending information as it occurs.

Popular mobile apps for following a budget include Mint, PocketGuard and Dollarbird. Mint is free to use, but the others have monthly subscription fees.

Paper Budget Planners

As convenient as mobile apps for budgeting may be, they’re not suitable for everyone. Many people prefer to put pen to paper physically. In that case, there are tons of options.

On the simplest level, you can use a plain notebook to track expenses and income. Since it’s not organized, however, you may struggle to gain a clear understanding of your situation.

Some people create spreadsheets in programs like Excel, print them out and then fill them in throughout the month. That’s fine if you are adept at using such programs, but it also has significant limitations.

Finally, designated paper budget planners are excellent options for those who prefer putting pen to paper and want guidance and direction. Clever Fox makes a well-designed, undated budget planner designed for on-the-go use. This monthly budgeting journal includes predefined expense categories, end-of-month review sections and many other valuable features.

Clever Fox also makes a budget planner and monthly bill organizer, which adds a bill organizing system. It includes a pocket for every month where you can store bills, receipts and other documents.

Whether you opt for a mobile app or a paper budget planner, choosing a tool to organize your budgeting system is a terrific first step toward achieving and maintaining financial stability.

Step #2 - Identify Your Financial Goals

Before embarking on your budget planning venture, it’s wise to establish financial goals to keep you motivated. Setting goals also helps you put your budget to practical use.

Some common financial goals that people set when creating a budget include the following:

- establishing an emergency fund

- saving for a significant purchase like a house or car

- saving for retirement

- paying off debt

- saving for college

Once you’ve established financial goals, set a deadline for when you’d like to achieve them. From there, align your budget around these goals and deadlines. For example, let’s say you want to save up $50,000 for a down payment in 5 years. You’ll want to add an expense category setting aside $833 per month to make it happen.

Alternatively, you can plan to set aside 20% of your income, with 15% going toward retirement savings and the rest going toward your goals.

Step #3 - Gather Your Financial Paperwork

To create a useful budget, it’s crucial to be as accurate as possible. When setting it up, then, you’ll need to gather as much financial information as possible, including electronic and paper bills and statements.

Some of the documents you’ll need to create your budget include the following:

- bank statements

- credit card statements

- pay stubs, W-2s and 1099 forms

- mortgage and rent statements

- car loan statements

- utility bill statements

- student loan statements

- car insurance bills

- phone bills

- documents reflecting child care expenses

These documents will show you in-depth information about your fixed expenses, which you’ll use to populate your budget.

Step #4 - Calculate Your Monthly Income

To make your budget as effective as possible, you need to have a firm grasp of your monthly income.

If you’re a full-time employee receiving regular paychecks, use your net monthly income – the amount you take home after taxes.

If you’re a seasonal or freelance employee, base your monthly income on your lowest-earning month of the past year. In fact, you might consider paying yourself a “salary”: When creating your budget, establish a basic monthly income based on the average amount you’ve earned per month over the past year or on your worst month. If you earn more than that in a given month, put the excess into savings.

Make sure to list all sources of income, including alimony or child support, side gigs and investments.

Step #5 - Make a List of Your Monthly Expenses

Pull information for fixed, monthly expenses from the documents you gathered in Step 3.

For variable expenses like groceries, gas, dining out and non-essential shopping, calculate an average for each category based on spending from the last three months. You may have to start tracking these categories for a while before creating a firm budget.

Finally, don’t forget about irregular expenses that crop up throughout the year. Irregular expenses include things like birthday and holiday gifts, vehicle registration fees, professional dues and annual doctor and veterinarian visits. When setting up your budget for the upcoming month, refer to the calendar to see if any are on the horizon.

Step #6 - Categorize Your Expenses and Establish Spending Limits

Set up categories for your fixed and variable expenses. Many mobile apps have common ones already in place, and they usually allow you to create custom categories.

Common categories for fixed expenses include rent, mortgage, car loan and vehicle insurance. Common categories for variable expenses include groceries, dining out, gas and public transportation.

Make sure to include categories for the goals you’ve set too. Such categories may include an emergency fund, paying off a debt or saving to buy a house.

From there, figure out how much you’re spending every month on each category. This is easy to do for fixed expenses. For variable ones, use a three-month average.

Finally, establish spending limits for variable expenses. You can adjust these as needed as you follow your budget and put it to use.

Step #7 - Choose a Type of Budget to Follow

At the very least, your budget should allow you to pay all of your expenses while still leaving some money left over. Many people find it helpful to follow specific budgeting plans, so it pays to explore the most popular ones.

For example, the 50/30/20 rule popularized by Senator Elizabeth Warren of Massachusetts offers a simple guide for achieving financial stability. It entails earmarking 50% of your monthly income for essentials, 30% for non-essentials and 20% for savings or paying off debt.

Another option to consider is the zero-based budget popularized by Dave Ramsey. Its underlying philosophy is to tell your money where to go rather than wonder where it went. The goal with this budget type is to make your income minus your outflow equal zero. Every dollar has a job. It doesn’t mean you end up with no money at the end of the month; rather, you assign some to savings and others to various categories.

Step #8 - Adjust Your Budget

After tracking your budget for a month, analyze where you’re at to get a clear picture of your current financial situation. If you are earning more than you’re spending, you’re already in excellent shape – especially if you’re also setting aside money for savings.

If you discover that you’re not earning enough to pay for monthly expenses, you’ll have to take steps to correct the issue. You might start by looking at your variable expenses and finding categories where you can reduce your spending. For example, perhaps you can forgo your regular expensive coffee drinks for a while.

Sometimes, cutting back on variable expenses isn’t enough. In that case, you’ll have to look at your fixed expenses and find ways to reduce them. For instance, perhaps you could take on a roommate or sell your car and buy a less expensive one.

Another way to deal with a deficit in your budget is by earning more money. For example, you might take on a side gig delivering food or sell old, unneeded items.

Adjust your budget according to the changes you’ve made to address whatever issues you’re having.

Step #9 - Use Your Budget

With your new budget for the month in place, it’s time to use it. Using it means tracking, monitoring and planning for expenses in each of the categories you’ve established.

Ideally, you should track your expenses on a daily basis. Whether you use an app or a paper planner, get into the habit of inputting your spending info as it occurs. Waiting until the end of the month makes it easy to leave out important figures.

Detailed expense tracking allows you to discover negative spending habits more easily. If you reach the limit in a particular category, you’ll know to stop spending in that area or to move money from another category into that one.

Step #10 - Hold Yourself Accountable

Finally, find ways to hold yourself accountable to your budget to ensure that it goes the distance for you.

Some ways to hold yourself accountable to your budget include the following:

Automate Everything You Can

Things are less likely to slip through the cracks when you automate them. Therefore, set up as many fixed expenses to be paid automatically every month.

That way, the money will go out on time, eliminating the risk of late fees and other issues. Set up automatic transfers into your retirement and savings accounts – if the money is socked away before you “see” it, it’s easier to manage.

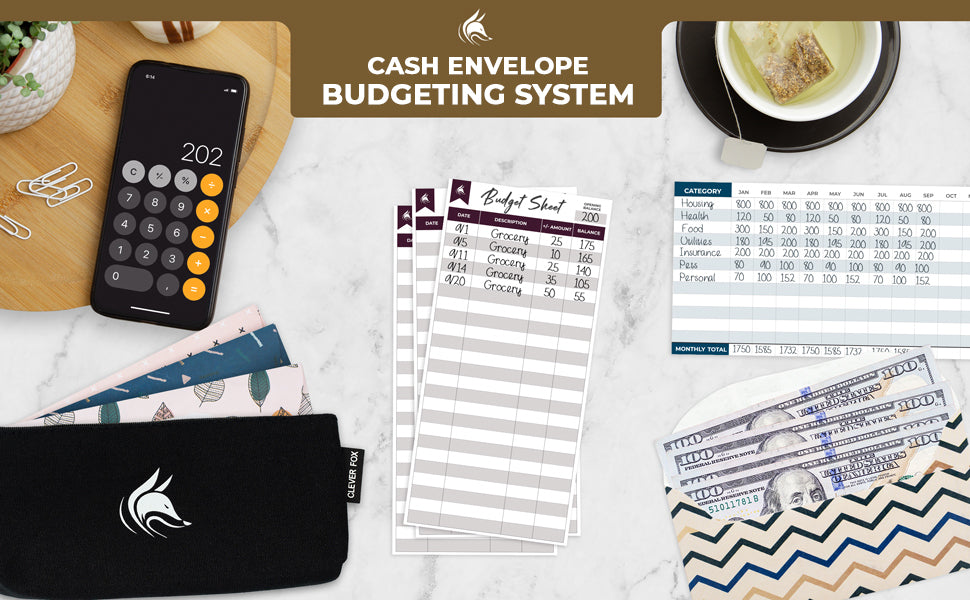

Try the Envelope System

Some people find it easier to get a clear picture of their spending by using a method known as the envelope system. This system involves creating labeled envelopes for variable expense categories and placing cash inside them at the start of every month.

Once an envelope is empty, you know that you can’t spend more in that area until next month.

Conduct a Monthly Review

At the end of each month, analyze your budget to see how you fared with it over the last four weeks. Where did you overspend? Which categories had money left over?

Use this information to make adjustments to your budget and to achieve your financial goals more effectively and efficiently.

It’s also essential to get everyone in the household on board with the new budget to keep things moving in the right direction. With that in mind, schedule a monthly household meeting to go over the budget together.

Sometimes, one person sticks to the budget better than the other, and these meetings are where you can hash things out to stay on track.

Tips for Making the Most of Your Budget

Now that you know the basic steps for creating a budget, you’re on your way to achieving financial stability. At first, following a budget can be daunting, but most people adjust to it quickly. Here are some tips to help you make the most of your budgeting endeavors:

- Be Realistic – Just because you write something in your budget doesn’t mean it is doable. With that in mind, be realistic. If you have a shortfall in one category, don’t make drastic cuts to another unless you’re sure it’s reasonable. For example, deciding to slash your monthly grocery budget from $500 to $100 isn’t practical and is sure to backfire on you before too long.

- Include Some Wiggle Room – No system is perfect, so leave a bit of wiggle room for inevitable unexpected expenses. Reserving an extra $50 or $100 is more than enough for most people. Include this cushion as a line item in your budget. If you spend it, fine; if you don’t, you can move it over to your savings account or another category the following month.

- Be 100% Honest – Be as accurate as possible when inputting spending information. It can be tempting to gloss over small purchases, treating them as inconsequential, but they really do add up. The more detailed information you can provide, the better your results. Even if something seems minor, track and include it to gain the clearest picture you can.

- Only Track Credit Card Debt – Not Credit Card Spending – There’s an important distinction between credit card debt and credit card spending. The former should be included as a category in your budget and refers to debt that carries over from month to month. The latter is stuff you charge on your credit card but pay off in full every month, so you shouldn’t include it as a category in your budget.

- Base Income Information Off of Net Pay – In the income category of your budget, only list your actual take-home pay. In addition to taxes, your employer may withhold money from your paychecks for health insurance or retirement savings.

If you experience a deficit while tracking your budget, here are some ways to get back on track:

- Avoid Accumulating Credit Card Debt – Save up for major purchases instead of charging them to credit cards. If you charge them, you’ll have additional interest charges, and they can negatively impact your budget.

- Consider Big Purchases Carefully – Before splurging on a major purchase, ask yourself if it’s worth the impact it will have on your budget and consider saving up for it instead.

- Be Willing to Make Big Changes, If Necessary – When push comes to shove, you may have to consider downgrading to a smaller, more affordable home or making other big spending changes.

- Try Meal Planning – People often overspend on dining out and groceries. A great way to keep those costs in check is by planning your meals every week. Clever Fox offers a convenient paper meal planner that makes it easy to get on track in this regard.

Gain Control of Your Financial Future By Creating a Budget Today

Although it sounds nice, very few people can spend whatever they want, whenever they want. Without a measured approach to finances, it’s easy to end up in a serious debt spiral or live paycheck-to-paycheck for years, constantly stressing about money.

Creating a budget – and following it – is one of the simplest ways to stay on track with your finances. It takes a little getting used to, but it can be genuinely life-altering once you’re on track. Take control over your finances by getting started budgeting today!